|

|

Capital and Revenue Receipts.

Welcome to Capital and Revenue receipts topic. Under this part, learn definitions of Capital Receipts and Revenue Receipts, understand the important differences between Capital Receipts and Revenue Receipts, understand the effect of incorrect treatment of capital receipts and revenue receipts on profit for the year and on the statement of financial position.

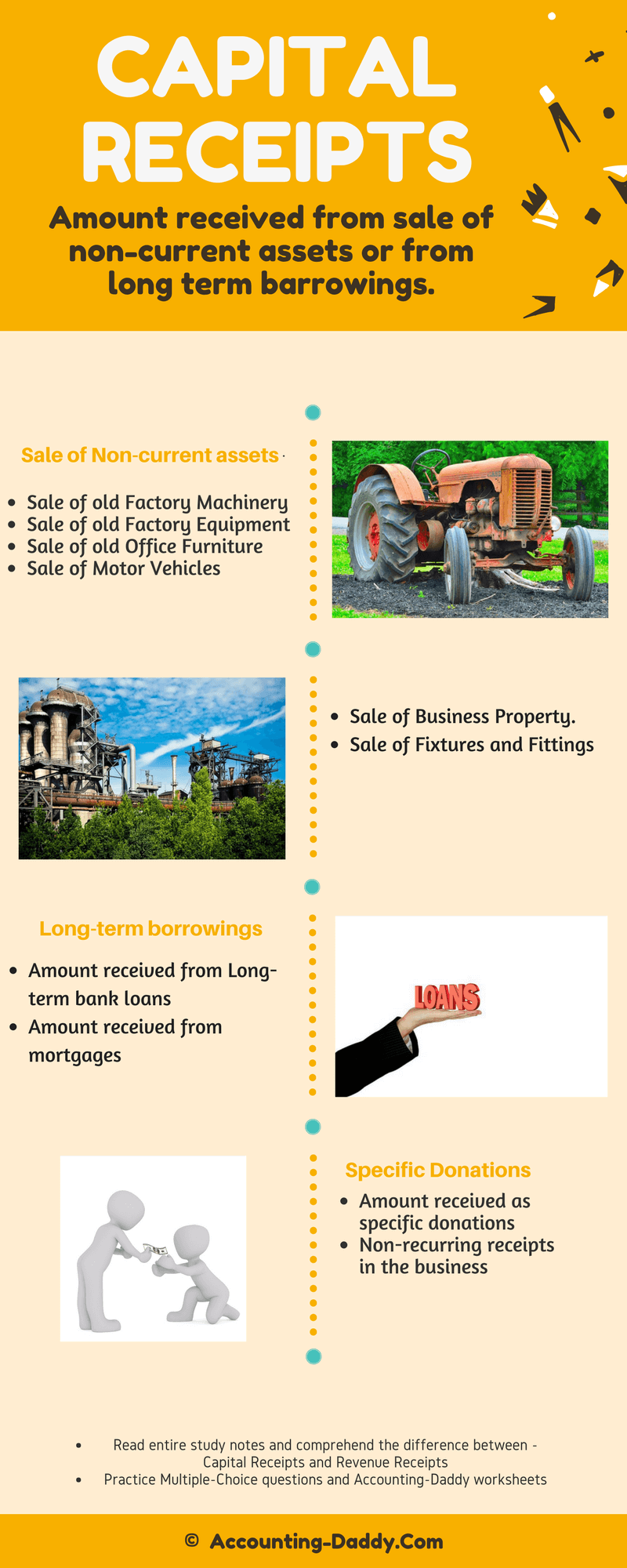

Capital Receipt.

“Amount received from the sale of a non-current asset or the receipts which do not reoccur in the same accounting year is known as Capital Receipt.”

Check out the following examples to comprehend the capital receipts.

1. Amount received from the sale of old Plant and Machinery.

2. Amount received from issue of fresh share capital.

3. Amount received from issue of debenture.

4. Amount received from specific donations.

5. Amount received from the mortgage of property.

6. Amount received from a long-term bank loan.

Important points to remember:

- Capital Receipts either decrease the value of a non-current assets or increase the value of a non-current liabilities.

- Capital Receipts are of non-reoccurring nature. They do not recur in the same accounting year.

Check out the following links:

- Netizens define Capital Receipts and Revenue Receipts! (External link)

Revenue Receipt.

“Amount received from normal day-to-day trading activities of the business is known as revenue receipt.”

Check out the following examples to comprehend the Revenue Receipts:

1. Amount received sale of inventory.

2. Discount received from trade payables for prompt payment.

3. Commission received from the manufacturer.

4. Finance Income received from “The Bank of England.”

5. Entrance fee or membership fee received from the members.

Important points to remember:

- Revenue receipts are of recurring nature. They recur several times in an accounting year.

- Revenue receipts are recorded in the Income Statement.

- Revenue receipts increase the Gross Profit and/or Profit for the year.

Segregation of a single receipt as Capital and Revenue receipts.

From the above explanation and examples, we comprehend what a capital receipt is and what a revenue receipt is. However, sometimes we need to treat a single receipt as both capital receipt and revenue receipt. Though it is sporadic to get questions from this area in O level Principles of Accounts and IGCSE Accounting, we can not completely rule out the possibility of getting questions from this area.

Eg:(Past paper question): O Level Principles of Account (7110/12-Paper 1-Multiple Choice-October/November 2013=Q.No:11)

So, let us discuss, how to treat a single receipt as both capital and revenue receipt.

For example. We bought a motor vehicle at the cost price of $ 5,000 and after three years of usage we have decided to dispose it, and on that day, it’s book value stands at $2 900.

Let's discuss three different scenarios:

Scenario One: We sold the motor vehicle for $2,500

Note: if the sale proceeds are less than the book value of the asset, entire sale proceeds must be treated as Captial Receipt.

So, $2,500 is Captial Receipt.

Scenario Two: We sold the motor vehicle for $4,500

Note: If the sale proceeds are more than the book value and less than the cost price, then the receipt should be divided as:

- Up to book value of the asset is Captial Receipt

- Excess of book value is Revenue Receipt.

So, $2,900 is Capital Receipt and $1,600 is Revenue Receipt.

Scenario Three: We sold the motor vehicle for $5800

Note: If the sale proceeds are more than the cost price of the asset, then the receipts should be divided as:

- Up to book value of the asset is Capital Receipt

- Between book value and Cost is Revenue Receipt

- The excess over cost price is Capital Receipt.

So, the total Capital Receipt is $3,700 and Revenue Receipt is $ 2,100.

The differences between Capital and Revenue Receipts.

| S.No | Capital Receipts | Revenue Receipts |

|---|---|---|

| 1. | It is an amount received from the sale of a non-current asset. | It is an amount received from the day-to-day running activities of the business. |

| 2. | The amount received is usually more. | The amount received is usually little. |

| 3. | It is a non-recurring receipt. | It is a recurring receipt. |

| 4. | It appears in the Statement of Financial Position. | It appears in the Income Statement. |

|

|

New! Comments

Have your say about what you just read! Leave us a comment in the box below.