|

|

- Home

- Accounting

- Control Accounts

- Sales Ledger Control Accounts

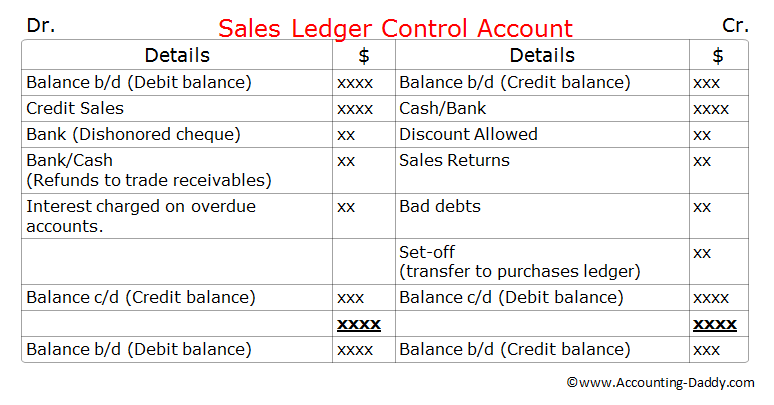

Sales Ledger Control Account.

Sales Ledger Control Account is a summary account which checks the arithmetical accuracy of the Sales Ledger. It enables us to see at a glance whether the general ledger balance for the sales ledger agrees with the total of all the individual trade receivable accounts held within the sales ledger.

Sales Ledger Control Account typically looks like a "T-Account" or a replica of an Individual Trade Receivable ( Debtor) account, but instead of containing transactions related to one trade receivable (Debtor) it contains transactions related to all the trade receivables (all the debtors) in the business. As this control account contains the summarized information of all the trade receivables accounts in the sales ledger, it is also called as "Total Trade Receivables Account"("Total Debtors Account").

Check out the format of this control account below and try to perceive the similarities with individual trade receivable account (Debtors account).

Format:

Sales ledger control account is generally prepared at the end of the financial year or "whenever" it is required to check the arithmetical accuracy of the individual trade receivable accounts.

As we discussed earlier, this control account is prepared as an independent check on the arithmetical accuracy of the sales ledger (Debtors Ledger). So, we should not obtain the information required to prepare this control account from the Sales ledger (Debtors ledger), instead all the information required should be obtained from books of original entry or prime entry.

How to check the arithmetical accuracy of the sales ledger:

Once the control account is prepared using the above format with the information obtained from various books of prime entry/original entry, the total of balances on the individual trade receivable accounts in the sales ledger should match with the closing balances on the Sales ledger control account.

If the closing balances of sales ledger control and the total of balances on the individual trade receivable accounts in the sales ledger agrees, we can presume that there are no errors or fraud occurred in the sales ledger. If the balances differ, it indicate that there are errors in the individual trade receivables accounts in the sales ledger or in the control account. So to locate these errors, accountants need to check each and every trade receivables account in the sales ledger carefully until the error is found or the fraud is detected.

Source of information for Sales Ledger Control Account:

The following table provides the details of source of information for the sales ledger control account items.

|

S.No |

Item |

Source of information |

|

1. |

Opening trade receivables (opening debtors) |

Total of Trade Receivable' balances at the end of the previous accounting period. |

|

2. |

Credit Sales |

Total Credit Sales from the Sales Day Book (Sales Journal). |

|

3. |

Sales returns (Return inwards) |

Total sales returns from the Return Inwards Day book (Sales returns journal). |

|

4. |

Cash received |

From the cash column on the debit side of the Cash Book. |

|

5. |

Cheques received |

From the bank column on the debit side of the Cash Book. |

|

6. |

Discount allowed |

Total of the Discount column on the debit side of the Cash book. |

|

7. |

Bad debts written off |

From the the Journal (Proper Journal). |

|

8. |

Dishonored cheques |

From the bank column on the debit side of the Cash book. |

|

9. |

Refunds to trade receivables |

From cash/bank column on the credit side of the Cash book. |

|

10. |

Set off (Transfer to Purchases ledger) |

From the Journal (Proper Journal). |

|

11. |

Interest charged on overdue accounts. |

From the Journal (Proper Journal). |

|

12. |

Closing Trade receivables (closing debtors) |

Total of Trade Receivable' balances at the end of the current accounting period. |

Items should not be entered in the Sales Ledger Control Account.

The following items are often seen in the control account questions. As these times are closely related to the "sales and trade receivables", students often confuse and record them in the S L Control Account. But these items should not be recorded in the control accounts. Lets check these items below.

1. Cash Sales:

Cash sales are recorded cash book but not in the sales ledger. So cash sales should not be entered in the S L Control account which checks the arithmetical accuracy of the sales ledger.

2. Recovered bad debts:

If previously written off bad debts are recovered now, it should not be recorded in the S L Control Account as "bad debts recovered account appears in the general ledger but not in the sales ledger.

3. Increase or decrease in the provision for doubtful debts:

Provision for doubtful debts account is kept in the general ledger. An increase or decrease in the provision for doubtful debts affects the general ledger but not the Sales Ledger. So it should not be recorded in the S L control accounts.

Reasons for opening and closing credit balances in the S L control account:

Trade Receivables (debtors) accounts generally shows debit balance in the business books. This balance represents money owed by the trade receivable (debtor) to the business. However some times trade receivable (debtor) account may show a credit balance. It indicates business owes money to the trade receivable. It may happen due to one of the following reasons:

- An error in one of the individual trade receivables account.

- Over payment made by the credit customer (trade receivable).

- Advance payment by the trade receivable for the goods.

- Accountant forgot to deduct the cash discount before collecting the amount from the credit customer.

- A Trade receivable returns the goods after making the full payment but he is not yet refunded.

|

|

New! Comments

Have your say about what you just read! Leave us a comment in the box below.